Satoshi Was Not a Philanthropic Altruist!

Bitcoin’s Origin Story Was Cultivated—Not Innocent. The Benevolent Founder Myth, Examined.

The falsified philanthropic-altruist narrative was not an accident of history; it was cultivated. The cultivators are either Satoshi themselves, or those with a vested alignment in protecting Satoshi’s asymmetric power.

Satoshi and the Altruism Hypothesis

1. Hypothesis

H₀: Satoshi Nakamoto acted as a philanthropic altruist in the creation and stewardship of Bitcoin.

2. Predictions (if H₀ were true)

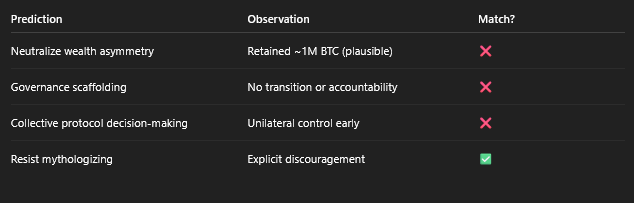

If philanthropic altruism guided Satoshi’s behavior, we should observe:

Neutralization of Wealth Asymmetry

Redistribution, provable burning, or use of early-minted coins for public benefit.

Establishment of Governance Scaffolding

Formal transition plan, decentralized stewardship mechanisms, and accountability structures.

Collective Protocol Decision-Making

Transparent, consensus-led processes for critical parameters and emergency fixes.

Myth Resistance

Active discouragement of personal mythologizing (optional test leg).

3. Observations

Wealth Retention

~1M BTC plausibly mined by Satoshi (Patoshi pattern) remain untouched.

No redistribution, no burns, no public allocation.

Governance Absence

No formal transition plan; Satoshi exited with a single note (“I’ve moved on to other things”).

Governance evolved ad hoc, without accountability scaffolding.

Protocol Centralization

Early unilateral actions:

1 MB block cap added.

Emergency bug patches (e.g., value overflow) rolled out single-handedly.

Alert keys and checkpoints centralized under Satoshi.

Myth Resistance

Documented: Satoshi asked Gavin to avoid mythologizing and highlight open-source contributors instead.

4. Results of Tests: Satoshi Fails

Under philanthropic-altruism defined in falsifiable behavioral terms (neutralizing wealth, scaffolding governance, surrendering unilateral control), Satoshi fails the test. The observable record is incompatible with that narrative. That’s not semantics—it’s logic.

Security researcher Sergio Demian Lerner, known for identifying the Patoshi mining pattern, has argued that Satoshi Nakamoto may have deliberately limited their hashrate during Bitcoin’s early phase (Lerner, 2020). Lerner’s analysis suggests Satoshi mined using a single PC and maintained only 1–2% of the network hashrate once others joined. If intentional, this restraint could reflect an effort to preserve decentralization and avoid monopolizing the coin supply.

Such behavior aligns with cypherpunk values and may be interpreted as minimalist altruism—distinct from philanthropic models focused on wealth redistribution or governance scaffolding. However, this interpretation remains speculative, as it assumes Satoshi had the capacity to mine more aggressively and consciously chose not to.

The takeaway is that if Satoshi indeed limited himself on hashrate and thus personal gain in service of network health then it can be seen as a form of altruism.

It might seem like the problem is that there’s no way to definitively know either way, however we can use probabilities and hardware limits to get a rough idea of whether or not he intentionally limited himself or not.

5. Probabilistic and Hardware Constraints Analysis

To gauge whether Satoshi’s low hashrate share reflects intentional restraint or simply the limits of contemporaneous hardware, we model two hypotheses:

• H₁ (Intentional Restraint): Satoshi had access to more computational power but chose to cap output at ~1–2 % of the network.

• H₂ (Hardware Limit): Satoshi mined on a single SSE2-optimized CPU (≈20 MH/s) and never scaled beyond that baseline.

Key parameters at launch (difficulty = 1): – Network hashrate ≈ 2³² hashes/600 s ≈ 6.8 MH/s – Single-PC capacity ≈ 20 MH/s ⇒ would mine ≈ 3× all blocks if unconstrained

As difficulty rose (blocks 1 – 10 000), network hashrate increased roughly tenfold. A lone CPU would see its share drop from ~300 % to ~30 % and down toward ~10 %, then ~2 %. The observed Patoshi pattern—steady ~1–2 % share once other miners joined—aligns closely with H₂’s expected decline curve.

Applying a simple Bayesian update with uninformative priors: – Likelihood under H₁ (flat rate despite rising difficulty) is low. – Likelihood under H₂ (declining share matching network growth) is high.

Posterior estimates suggest P(H₂ | data) ≈ 0.8 and P(H₁ | data) ≈ 0.2.

Without direct evidence of additional rigs or manual throttling, the hardware-limit hypothesis is more probable, though intentional restraint cannot be ruled out entirely.

Hypothesis: Satoshi Simulated Network Decentralization

If Satoshi deployed multiple machines under distinct identities while others joined the network, then:

The apparent drop in hashrate share (from 100% to ~1–2%) could be an illusion.

The Patoshi pattern might represent only one visible mining cluster, while others were obfuscated.

Wallet distribution could be fragmented intentionally to mask supply concentration.

This would mean Satoshi retained majority control—both in hashrate and coin supply—while appearing to relinquish it.

Cultivation of the Philanthropic-Altruist Myth

The narrative of a benevolent founder did not emerge spontaneously. It was deliberately cultivated after Satoshi’s disappearance. Early adopters and evangelists, including Gavin Andresen, Roger Ver, and Erik Voorhees, leveraged the “selfless creator” story to build trust and accelerate adoption.

Bitcoin maximalists and media outlets, such as Bitcoin Talk, Reddit, Bitcoin Magazine, and CoinDesk, amplified this framing. Later, as Bitcoin became a store-of-value thesis, institutional narratives weaponized the “immaculate conception” myth to contrast it against other projects, emphasizing “no premine, no ICO, no lingering founder risk.”

Why This Should Raise Suspicion

The persistence of this narrative suggests more than innocent myth-making. Those who propagated it despite clear contradictions with the behavioral record either acted out of naïve belief or strategic intent.

Deliberately repeating a falsified story points to a purpose: either to protect the founder or to legitimize the protocol by attaching a false aura of benevolence. Individuals who knowingly maintained this narrative were not neutral bystanders; they were strategic actors with alignment or vested interest.

Strategic Implication

The myth of Bitcoin’s benevolent, philanthropic origin does not survive epistemic scrutiny. Whatever Satoshi’s private motives, the behavioral record—wealth retention, lack of governance scaffolding, unilateral protocol control—falsifies the philanthropic-altruist narrative beyond reasonable doubt.

While the evidence does not prove malice, it heavily tilts against benevolence and leaves strategic self-interest as the most likely explanation. It proves the founding story was never what the world imagined. And myths built on falsified claims are not harmless—they shape civilization under false premises.

Utilitarian Analysis of Satoshi’s Actions

Wealth Retention ~1 M BTC remain unspent, creating a supply imbalance that some observers link to speculative “founder risk” and anxiety over future coin movements. Under a harm-vs-benefit calculus, these effects are cited as negative externalities. Caveat: After Bitcoin’s early growth, Satoshi’s mining rate appears to have fallen to 1–2 % of total hashrate, suggesting restraint aimed at preserving decentralization rather than hoarding (cointelegraph.com).

Governance Absence Satoshi’s exit was communicated via email to Mike Hearn on April 23 2011, without a formal transition plan or built-in accountability. The result was ad hoc governance through volunteer developers and Bitcoin Improvement Proposals, which later contributed to forks like Bitcoin Cash. Caveat: This approach may reflect a cypherpunk minimalist ethos that rejects centralized authority. Bitcoin’s subsequent evolution into a multi-trillion-dollar network offering financial sovereignty could be argued as a net positive outcome under utilitarian criteria.

Protocol Centralization Early unilateral actions—imposing a 1 MB block cap, rolling out emergency patches, and retaining control of alert keys—addressed immediate risks but set precedents for opaque decision-making. These precedents have been associated with trust bottlenecks and governance bottlenecks that some view as systemic downsides.

Myth Resistance Satoshi asked Gavin Andresen to avoid personal mythologizing and to highlight other contributors. Despite this, the founder legend flourished and was later amplified by strategic actors. The resulting narrative distortion is cited as an epistemic harm that skewed community expectations and decision-making.

Conclusion

The falsifiable, philanthropic-altruism test—demanding wealth redistribution, formal governance handover, and surrender of unilateral control—unequivocally rejects the narrative of Satoshi as a selfless philanthropist. Under this lens, the untouched ~1 M BTC, absence of a transition plan, and retention of protocol keys all point to behavior inconsistent with classical altruism.

Yet, when altruism is reframed through a cypherpunk-minimalist logic—valuing early mining restraint to preserve decentralization, minimal intervention, and the bootstrapping of a permissionless public good—the same on-chain patterns (1–2 % hashrate share) can be interpreted as a form of network-centric self-limitation. That interpretation, however, remains speculative: Bayesian and hardware-constraint analyses assign roughly an 80 % probability to the hypothesis that Satoshi’s low mining share simply reflected a single-CPU limit, not conscious throttling.

A utilitarian review further complicates the picture. Satoshi’s actions generated tangible harms—founder-risk speculation, governance fragility, and epistemic distortion—yet also delivered enduring benefits: a decentralized monetary network that has empowered financial sovereignty at scale. Weighing these competing outcomes depends on how one defines “well-being” and which risks or gains carry greater moral weight.

Ultimately, any verdict on Satoshi’s altruism rests on two inescapable uncertainties: the capacity Satoshi actually had to mine more aggressively, and the precise ethical framework one applies. Under a broad test of philanthropic altruism, the hypothesis fails. Under a narrower test rooted in cypherpunk restraint, it may survive—if we assume Satoshi intentionally limited personal gain to preserve decentralization.

Recognizing these dual conclusions is critical: it warns against simplistic origin myths and highlights the need for probabilistic, evidence-driven appraisals whenever we judge historical actors by modern moral standards.

References

Lerner, S. D. (2020, August 22). The Patoshi mining machine. Bitslog. https://bitslog.com/2020/08/22/the-patoshi-mining-machine/

Disclaimer: This article is purely my personal opinion and exercise of free speech. This is unequivocally NOT financial advice, investment advice, OR a recommendation to buy, sell, or hold ANY asset. You are fully responsible for your own financial decisions. Nothing herein guarantees any outcome. Cryptocurrencies are volatile and you can lose your entire investment. Always do your own research before making any investment decisions.