Kaspa’s Evolution: From Testbed to Fast Follower

Bitcoin wasn’t built for ASICs and its S-curve points to inevitable replacement by a fast follower.

Bitcoin as a Testbed

The whitepaper’s “one-CPU-one-vote” assumption suggests Satoshi didn’t anticipate ASICs. Within a few years, mining consolidated into industrial farms, undermining the egalitarian vision of decentralized consensus.

This blind spot implies Bitcoin may have been more than a currency experiment. It may have been a live testbed to expose stress points in a permissionless monetary system.

Bitcoin unintentionally became the perfect laboratory:

Hardware specialization: to see how quickly custom silicon would emerge and how it would reshape mining incentives.

Governance capture: to observe how exchanges, pools, and whales might centralize decision-making.

Scalability limits: to test how far a linear block structure could stretch before latency and throughput collided.

Even its 10-minute cadence and one-block chain topology can be seen as deliberate constraints like a sandbox to surface failure modes in time and space.

Which seems more plausible: The mastermind Satoshi had blind spots or they knew they’d have blind spots? If they anticipated unknowns then it would make sense to have set limits on Bitcoin so its network effects couldn’t out-pace the ‘better Bitcoin’ that was yet to be made as Satoshi waits for the data from the test-net.

If Satoshi truly missed ASICs, they were a visionary amateur; if they anticipated them but built Bitcoin anyway, then Bitcoin was always a prototype acting as a global stress test for decentralized order.

The Fast-Follower Dynamic

Every technological S-curve follows a pattern: invention, adoption, saturation, and eventual displacement. The pioneer defines the standard, but the fast follower perfects it. Netscape validated the browser; Chrome conquered it. Bitcoin validated decentralized money; its eventual successor will optimize it.

If you’re doubting whether or not Bitcoin follows an S-curve. Then I invite you to read this prior article that covers how Bitcoin is highly likely to follow an S-curve.

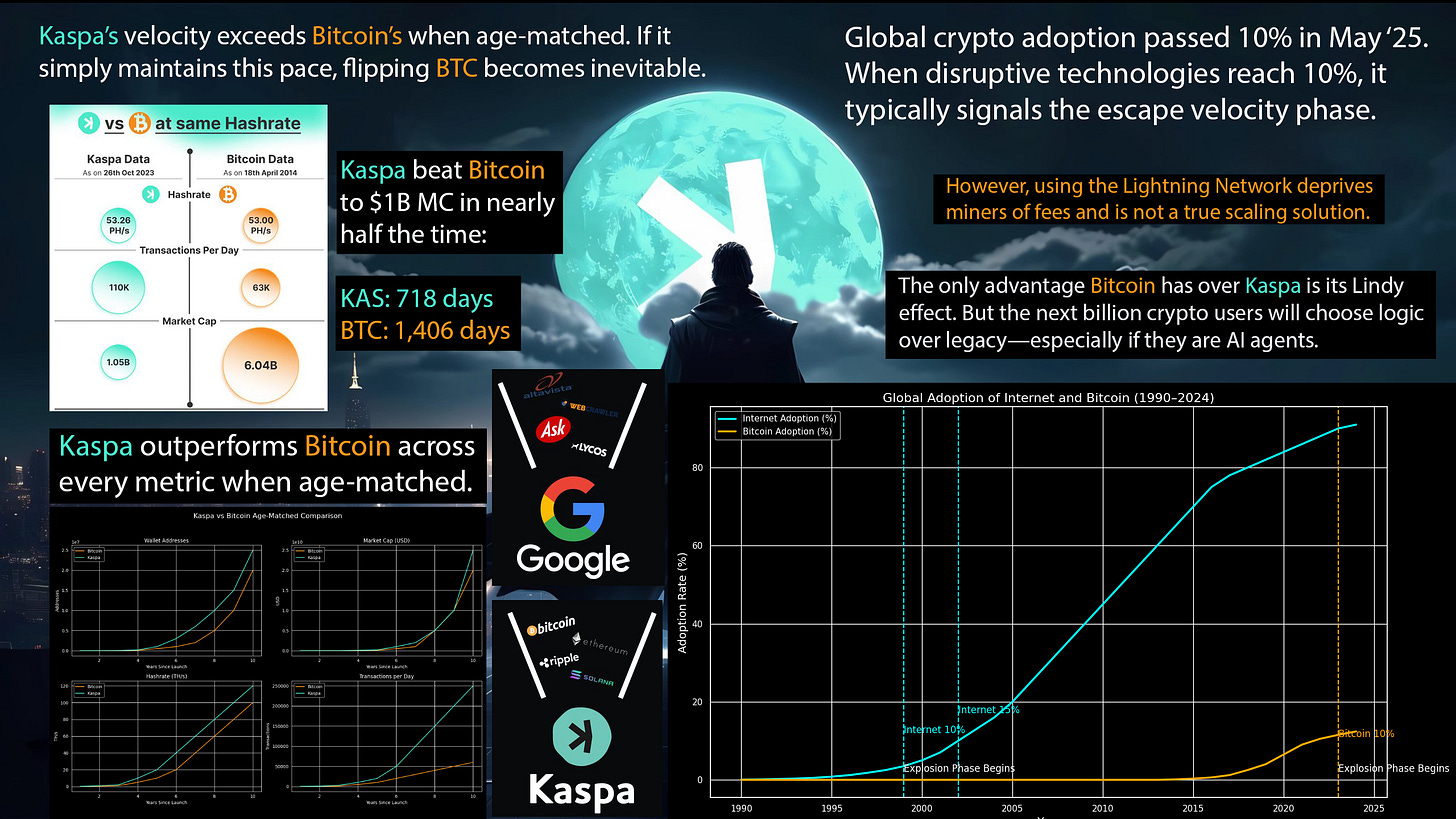

Kaspa aligns with that pattern in measurable ways:

Hyper-adoption alignment: Chainalysis projects global crypto ownership near 12.4% by 2025. As Bitcoin nears saturation, capital reflexivity shifts toward networks offering speed and efficiency without abandoning PoW principles—Kaspa’s exact niche.

Cross-asset reflexivity: Liquidity naturally rotates from BTC and ETH into emerging infrastructure plays. Kaspa benefits from that multi-reflexive dynamic, positioned as the “new” proof-of-work layer at a time when investors seek technical continuity and performance upside.

Erosion of Bitcoin’s Lindy edge: Bitcoin’s longevity no longer guarantees future dominance. AI agents, projected to control over $47B in transaction volume by 2030 (MarketsandMarkets, 2025; VanEck, n.d.), will optimize for latency, cost, and confirmation speed—not nostalgia. Efficiency will trump legacy.

Structural fatigue: Bitcoin’s fee reliance, rigidity post-Blocksize Wars, and recurring protocol debates (like the 2025 spam-size limit dispute) signal a system straining under its own immutability. Kaspa’s flexibility offers a contrast—proof-of-work without stagnation.

Kaspa doesn’t seek to overthrow Bitcoin’s ethos but to fulfill it. Its very existence suggests that Bitcoin’s experiment worked: it exposed the design flaws the next generation could fix.

Kaspa as the “Better Bitcoin”

If Bitcoin was the prototype, Kaspa looks like the refined iteration or the “fast follower” that fixes structural flaws while preserving the original ethos of proof-of-work, fairness, and transparency.

Fast blocks: Kaspa’s 100-millisecond block times enable near-instant confirmation and internet-speed consensus.

Horizontal scalability: Its BlockDAG architecture escapes Bitcoin’s linear chain limits, allowing multiple blocks to coexist without sacrificing security.

Optical mining: Kaspa’s vision for photonic proof-of-work anticipates ASIC centralization before it returns, democratizing hardware efficiency.

Privacy choice: Founder Yonatan Sompolinsky advocates privacy as opt-in—preserving auditability while giving users selective confidentiality.

Kaspa internalizes Bitcoin’s hard-won lessons: decentralization must pre-empt hardware arms races; scalability must move beyond serialized time; privacy must balance individual freedom with system integrity.

No other network fully extends Nakamoto Consensus while mirroring Bitcoin’s spirit. Most competitors borrow its surface features, but Kaspa evolves its foundation.

Conclusion

Bitcoin may have been a deliberate testbed, designed to surface how decentralization survives capture. Kaspa, with its fast blocks, blockDAG scalability, optical mining ambitions, and opt-in privacy, is the logical successor. The “better Bitcoin” that front-runs ASICs with optical miners and transcends the limits of the original design.

If Bitcoin was the proof-of-concept for trustless money, Kaspa is the proof-of-evolution.

Disclaimer: This article is purely my personal opinion and exercise of free speech. This is unequivocally NOT financial advice, investment advice, OR a recommendation to buy, sell, or hold ANY asset. You are fully responsible for your own financial decisions. Nothing herein guarantees any outcome. Cryptocurrencies are volatile and you can lose your entire investment. Always do your own research before making any investment decisions.

References

Chainalysis. The 2025 Global Crypto Adoption Index: Top 20 & trends. (2025). Retrieved from https://www.chainalysis.com/blog/2025-global-crypto-adoption-index/ Chainalysis

Kaspa Project. Features – Kaspa: BlockDAG, optical mining ready, high throughput. (n.d.). Retrieved from https://kaspa.org/features/ Kaspa

Kaspa Project. Mining Kaspa – blockDAG, fair launch, kHeavyHash algorithm. (n.d.). Retrieved from https://kaspa.org/mining-kaspa/ Kaspa

MarketsandMarkets. AI Agents Market worth USD 47.1 billion by 2030 — Exclusive Report. (2024, Sept. 12). Retrieved from https://www.prnewswire.com/news-releases/ai-agents-market-worth-47-1-billion-by-2030---exclusive-report-by-marketsandmarkets-302246356.html PR Newswire

Van Eck. “Van Eck’s 10 Crypto Predictions for 2025.” Van Eck Digital Assets Blog, 2024. Retrieved from: https://www.vaneck.com/us/en/blogs/digital-assets/matthew-sigel-vanecks-10-crypto-predictions-for-2025/